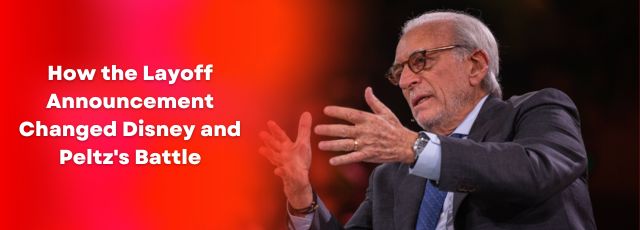

Overview of the Proxy Fight Between Nelson Peltz and Disney

On Thursday, billionaire activist investor Nelson Peltz stopped his proxy fight with Walt Disney Co. This happened after Chief Executive Bob Iger announced a significant restructuring and cost reduction program. This plan includes cutting 7,000 jobs. Peltz said on CNBC’s Jim Cramer show that Disney is now doing what they wanted them to do. He also wished the management team and the board the best and said that he will be watching and supporting them.

After being rejected by the company, Peltz started a proxy fight last month to try to join Disney’s board of directors. Now, he has declared that the fight is over. Throughout the process, he had been pushing Disney executives and board members since July.

The Real Impacts of Nelson Peltz’s Proxy Fight With Disney

Trian Fund Management, which is owned by Peltz, had bought 9.4 million shares worth approximately $900 million in Disney. Mr. Peltz sent letters to people who own Disney stock. He asked them to vote for him or his son to be on the board of directors instead of Michael Froman. He said that Disney was not making good plans for the future. He thought they spent too much money when they bought 21st Century Fox. This made Disney owe more money than before. Despite this, the acquisition brought in valuable properties such as “Avatar” and “The Simpsons.”

Disney said thank you to Trian Fund and all their shareholders. Nelson Peltz tried to change something when Bob Chapek was running Disney. But then in May Bob Chapek was let go and replaced by Iger, which could lead to other interests in 1xBet casino games online for money and the introduction of the gaming theme.

Iger initiated a restructuring and cost-cutting program to make the company’s popular streaming services profitable. However, the streaming strategy that Iger led before stepping down as CEO in 2020, is currently losing money despite gaining a large customer base. The direct-to-consumer business, including Disney+, Hulu and ESPN+, reported a loss of over $1 billion in the latest quarter.

How the Layoff Announcement Changed Disney and Peltz’s Battle

Disney aims to save $5.5 billion by cutting costs primarily from its content and marketing. Their plan is to reduce content spending, excluding sports, by $3 billion in the coming years. Nobody knows for sure when people will lose their jobs or which departments will have most job cuts. But experts it is likely that the media content businesses will suffer the most.

Disney is planning to focus on its major franchises, especially in animation. They are developing sequels to “Toy Story,” “Zootopia,” and “Frozen.” They can save money by cutting back on expenses in a different part of the business and getting rid of extra costs for their TV networks and movie studios. This information was shared by Morgan Stanley analyst Benjamin Swinburne in a note to clients.

On Thursday, Disney said that they are making three different parts. One is called Disney Entertainment and includes movies, TV, and streaming. Another part is ESPN. The last one is called Disney Parks, Experiences, and Products. This move aims and financial executives, as per

What Bob Iger Meant When He Said Disney Was ‘Intoxicated’ By Subscriber Growth

Swinburne expressed support for the plan, but also recognized the difficulties associated with it. He asked how Disney will decide what to put on their streaming services that do not make money yet.

Disney has assigned different leaders to various sections of their business. Alan Bergman and Dana Walden will be in charge of the entertainment division. This includes both Disney+ and Hulu. Jimmy Pitaro will take care of ESPN and ESPN+. Josh D’Amaro will be in charge of Parks, Experiences, and Products. The executives’ job is to make the business work better all over the world. That is what their boss, Iger, asked them to do.

As part of the company’s reorganization, some back-end departments responsible for product and technology, advertising sales, and distribution (excluding theatrical and music) will be combined to support both Disney Entertainment and ESPN. Additionally, international entertainment divisions will now report to Bergman, Walden, and Pitaro. This means that Rebecca Campbell, who is the chairman of international content and operations, will leave the company in June.

A Deeper Look At the Implications of the Proxy Fight Ended by Nelson Peltz

The effects of the organizational challenges are felt immediately. Moreover, the company plans to propose the reinstatement of shareholder dividends to the board, albeit the initial payments will be a portion of their previous amounts. The fact that ESPN is operating as a separate entity prompted inquiries about whether Disney intends to sell or separate the cable sports division. However, Iger has rejected these rumors.

Disney has announced that it is focusing on cost-cutting measures to address the losses incurred by its streaming services. However, it clarified that this does not mean it is giving up on its ambitions for Disney+, as the streaming business remains a key priority for the company.

Iger admitted that certain actions taken during his leadership to expand the streaming business were overly forceful. One instance was the launch of Disney+ in 2019, which cost only $6.99 per month, considerably lower than similar services. However, Disney had to raise the subscription costs thereafter.

Analysis of What This Means for Future Activist Investors Approaching Companies Like Disney

When asked about his retirement plans after his two-year contract expires, Iger, who is turning 72 on Friday, stated that his intention is indeed to leave. He explained that he has a contractual agreement with the board to stay for two years, and that is what he prefers to do. This means he plans to retire as agreed upon.

Disney exceeded Wall Street estimates in its financial results. They generated $23.5 billion in sales, which is an 8% increase compared to the same quarter last year. Analysts were expecting revenue of $23.4 billion on average. Disney’s profit increased by 11%, amounting to $1.28 billion. Additionally, the company’s earnings per share were 99 cents, surpassing the projected 78 cents.